What Services Are Exempt From Sales Tax In Nebraska . Deliveries into a nebraska city that imposes a local sales tax are taxed at the state rate (5.5%), plus the applicable local rate. While nebraska's sales tax generally applies to most transactions, certain items have special. Sales to nonprofit educational and religious organizations. Are services subject to sales tax? Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. This can include things like haircuts, car repairs, and housecleaning. Generally, services provided in nebraska are subject to sales tax. Code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption. There are exemptions to the rule, however.

from www.signnow.com

This can include things like haircuts, car repairs, and housecleaning. Code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption. Are services subject to sales tax? Sales to nonprofit educational and religious organizations. Deliveries into a nebraska city that imposes a local sales tax are taxed at the state rate (5.5%), plus the applicable local rate. While nebraska's sales tax generally applies to most transactions, certain items have special. Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. Generally, services provided in nebraska are subject to sales tax. There are exemptions to the rule, however.

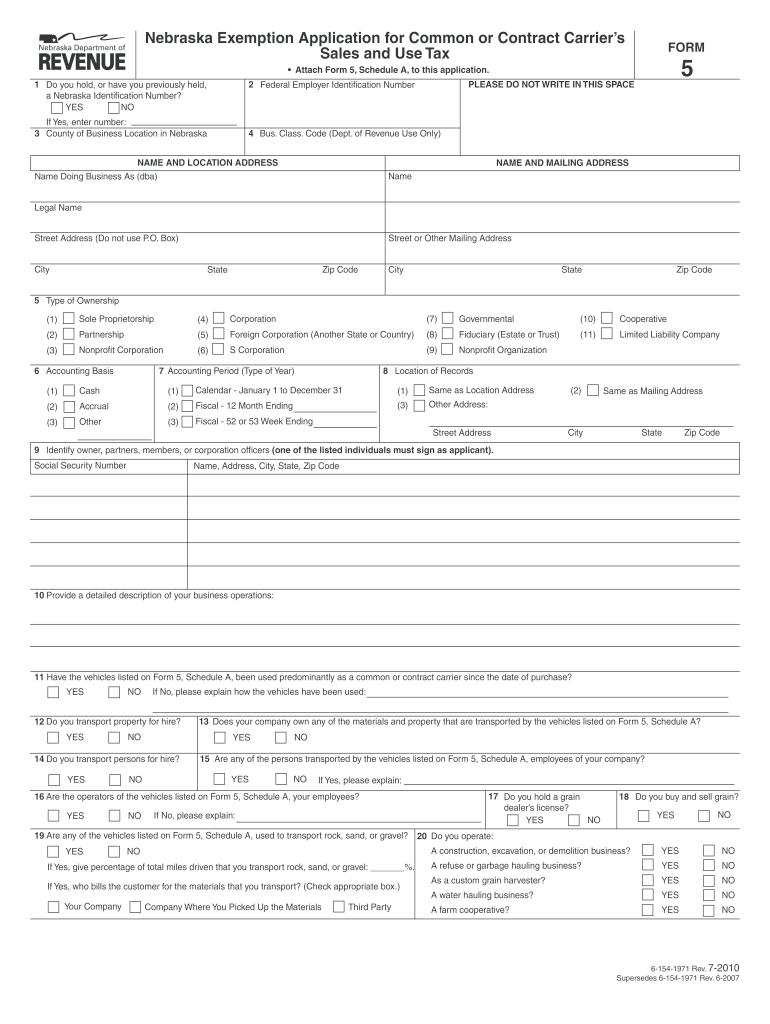

Nebraska Exemption Application for Common or Contract Carrier39’s

What Services Are Exempt From Sales Tax In Nebraska While nebraska's sales tax generally applies to most transactions, certain items have special. Deliveries into a nebraska city that imposes a local sales tax are taxed at the state rate (5.5%), plus the applicable local rate. There are exemptions to the rule, however. This can include things like haircuts, car repairs, and housecleaning. Sales to nonprofit educational and religious organizations. Code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption. Generally, services provided in nebraska are subject to sales tax. Are services subject to sales tax? Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. While nebraska's sales tax generally applies to most transactions, certain items have special.

From www.formsbank.com

Fillable Form 13 Nebraska Resale Or Exempt Sale Certificate For Sales What Services Are Exempt From Sales Tax In Nebraska This can include things like haircuts, car repairs, and housecleaning. Sales to nonprofit educational and religious organizations. Generally, services provided in nebraska are subject to sales tax. Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. There are exemptions to the rule, however. Deliveries. What Services Are Exempt From Sales Tax In Nebraska.

From www.formsbank.com

Instructions For Form 10 Nebraska And Local Sales And Use Tax Return What Services Are Exempt From Sales Tax In Nebraska Deliveries into a nebraska city that imposes a local sales tax are taxed at the state rate (5.5%), plus the applicable local rate. There are exemptions to the rule, however. Are services subject to sales tax? While nebraska's sales tax generally applies to most transactions, certain items have special. Officers must obtain a sales tax permit by filing a nebraska. What Services Are Exempt From Sales Tax In Nebraska.

From www.templateroller.com

Form 13 Fill Out, Sign Online and Download Fillable PDF, Nebraska What Services Are Exempt From Sales Tax In Nebraska Deliveries into a nebraska city that imposes a local sales tax are taxed at the state rate (5.5%), plus the applicable local rate. There are exemptions to the rule, however. This can include things like haircuts, car repairs, and housecleaning. Sales to nonprofit educational and religious organizations. Are services subject to sales tax? While nebraska's sales tax generally applies to. What Services Are Exempt From Sales Tax In Nebraska.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF What Services Are Exempt From Sales Tax In Nebraska Sales to nonprofit educational and religious organizations. While nebraska's sales tax generally applies to most transactions, certain items have special. There are exemptions to the rule, however. Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. This can include things like haircuts, car repairs,. What Services Are Exempt From Sales Tax In Nebraska.

From www.formsbank.com

Form 10 Nebraska And Local Sales And Use Tax Return Example printable What Services Are Exempt From Sales Tax In Nebraska Sales to nonprofit educational and religious organizations. Code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption. Are services subject to sales tax? This can include things like haircuts, car repairs, and housecleaning. There are exemptions to the rule, however. Deliveries into a nebraska city that imposes a local sales tax are taxed. What Services Are Exempt From Sales Tax In Nebraska.

From www.formsbank.com

Instructions For Form 13 Nebraska Resale Or Exempt Sale Certificate What Services Are Exempt From Sales Tax In Nebraska Deliveries into a nebraska city that imposes a local sales tax are taxed at the state rate (5.5%), plus the applicable local rate. There are exemptions to the rule, however. Are services subject to sales tax? This can include things like haircuts, car repairs, and housecleaning. While nebraska's sales tax generally applies to most transactions, certain items have special. Code,. What Services Are Exempt From Sales Tax In Nebraska.

From www.yumpu.com

Zerorated and exempt supplies What Services Are Exempt From Sales Tax In Nebraska Generally, services provided in nebraska are subject to sales tax. Are services subject to sales tax? Sales to nonprofit educational and religious organizations. Deliveries into a nebraska city that imposes a local sales tax are taxed at the state rate (5.5%), plus the applicable local rate. Code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following. What Services Are Exempt From Sales Tax In Nebraska.

From www.pdffiller.com

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank What Services Are Exempt From Sales Tax In Nebraska Are services subject to sales tax? Generally, services provided in nebraska are subject to sales tax. Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. Code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption. While nebraska's. What Services Are Exempt From Sales Tax In Nebraska.

From formspal.com

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online What Services Are Exempt From Sales Tax In Nebraska There are exemptions to the rule, however. Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. While nebraska's sales tax generally applies to most transactions, certain items have special. Sales to nonprofit educational and religious organizations. Generally, services provided in nebraska are subject to. What Services Are Exempt From Sales Tax In Nebraska.

From www.formsbank.com

Notice To Nebraska And Local Sales And Use Tax Permitholders printable What Services Are Exempt From Sales Tax In Nebraska Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. Sales to nonprofit educational and religious organizations. This can include things like haircuts, car repairs, and housecleaning. Deliveries into a nebraska city that imposes a local sales tax are taxed at the state rate (5.5%),. What Services Are Exempt From Sales Tax In Nebraska.

From www.templateroller.com

Form 13 Download Fillable PDF or Fill Online Nebraska Resale or Exempt What Services Are Exempt From Sales Tax In Nebraska There are exemptions to the rule, however. While nebraska's sales tax generally applies to most transactions, certain items have special. This can include things like haircuts, car repairs, and housecleaning. Generally, services provided in nebraska are subject to sales tax. Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an. What Services Are Exempt From Sales Tax In Nebraska.

From www.softwaresuggest.com

GST Exemption A Detailed List Of Exempted Goods and Services What Services Are Exempt From Sales Tax In Nebraska Generally, services provided in nebraska are subject to sales tax. Sales to nonprofit educational and religious organizations. This can include things like haircuts, car repairs, and housecleaning. Code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption. While nebraska's sales tax generally applies to most transactions, certain items have special. There are exemptions. What Services Are Exempt From Sales Tax In Nebraska.

From www.formsbank.com

Instructions For Form 10 Nebraska And Local Sales And Use Tax Return What Services Are Exempt From Sales Tax In Nebraska Are services subject to sales tax? This can include things like haircuts, car repairs, and housecleaning. While nebraska's sales tax generally applies to most transactions, certain items have special. Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. Deliveries into a nebraska city that. What Services Are Exempt From Sales Tax In Nebraska.

From www.softwaresuggest.com

GST Exemption A Detailed List Of Exempted Goods and Services What Services Are Exempt From Sales Tax In Nebraska While nebraska's sales tax generally applies to most transactions, certain items have special. This can include things like haircuts, car repairs, and housecleaning. Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. Are services subject to sales tax? Deliveries into a nebraska city that. What Services Are Exempt From Sales Tax In Nebraska.

From www.formsbank.com

Fillable Form 13 Nebraska Resale Or Exempt Sale Certificate printable What Services Are Exempt From Sales Tax In Nebraska There are exemptions to the rule, however. While nebraska's sales tax generally applies to most transactions, certain items have special. This can include things like haircuts, car repairs, and housecleaning. Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. Sales to nonprofit educational and. What Services Are Exempt From Sales Tax In Nebraska.

From www.formsbank.com

Form 10 Nebraska Schedule I Local Sales And Use Tax 2000 What Services Are Exempt From Sales Tax In Nebraska Sales to nonprofit educational and religious organizations. Are services subject to sales tax? Code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption. There are exemptions to the rule, however. This can include things like haircuts, car repairs, and housecleaning. Officers must obtain a sales tax permit by filing a nebraska tax application,. What Services Are Exempt From Sales Tax In Nebraska.

From www.templateroller.com

Form 10 Schedule I Download Fillable PDF or Fill Online Local Sales and What Services Are Exempt From Sales Tax In Nebraska There are exemptions to the rule, however. Code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption. Sales to nonprofit educational and religious organizations. Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. Deliveries into a nebraska. What Services Are Exempt From Sales Tax In Nebraska.

From www.exemptform.com

Non Profit Sales Tax Exemption Form Nebraska What Services Are Exempt From Sales Tax In Nebraska Officers must obtain a sales tax permit by filing a nebraska tax application, form 20, and request to file an annual sales and use tax. Deliveries into a nebraska city that imposes a local sales tax are taxed at the state rate (5.5%), plus the applicable local rate. Sales to nonprofit educational and religious organizations. While nebraska's sales tax generally. What Services Are Exempt From Sales Tax In Nebraska.